Net Operating Income (NOI) as a measure of property profitability

Net Operating Income (NOI) is a critical factor in determining the profitability of a property. It is calculated by taking the property’s income and subtracting its operating costs. Improving NOI can be a key indicator of improved efficiency and cost savings, providing a clearer picture of an investment’s profitability.

What are a property’s operating costs?

- Operations

Operating costs are a significant expense and include heating, cooling, water, sewage, and electricity costs. Additionally, operations include repair expenses, taxes, and property management fees.

- Maintenance

Maintenance costs cover the resources needed to ensure the building remains in good condition over time. This includes both planned and ongoing maintenance of the building’s systems and structure. - Tenant adjustments

Properties require ongoing adaptations to meet tenants’ needs, such as accessibility adjustments or layout changes to create additional office spaces, larger conference rooms, or other specific requests.

Develop the property – improve NOI – impact property value

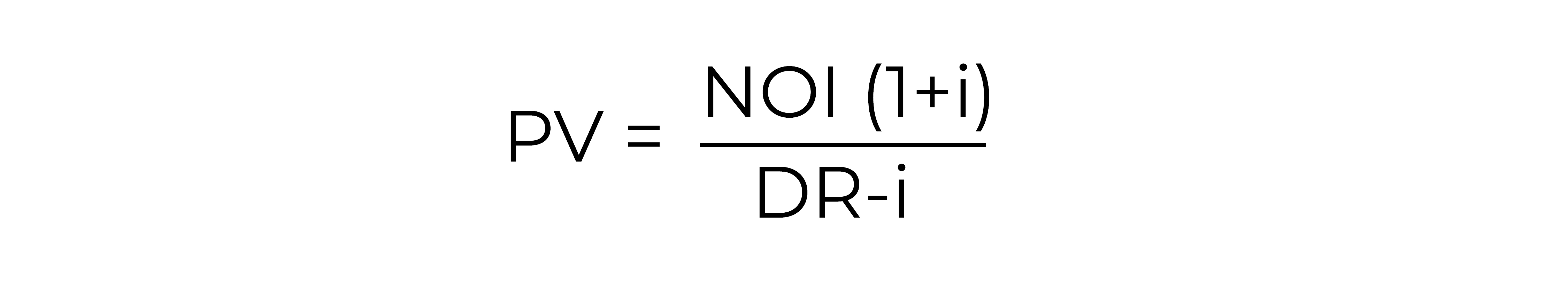

When considering an investment, it’s important to determine a discount rate for making long-term calculations and evaluations. This discount rate is typically based on the return that shareholders or investors expect. Property value (PV) can be calculated by taking the NOI and multiplying it by 1 plus the inflation rate (i), then dividing it by the discount rate (DR) minus inflation.

It doesn’t take significant changes in NOI to increase or decrease a property’s value. Each investment in energy efficiency not only results in cost savings but also increases the property’s overall value.

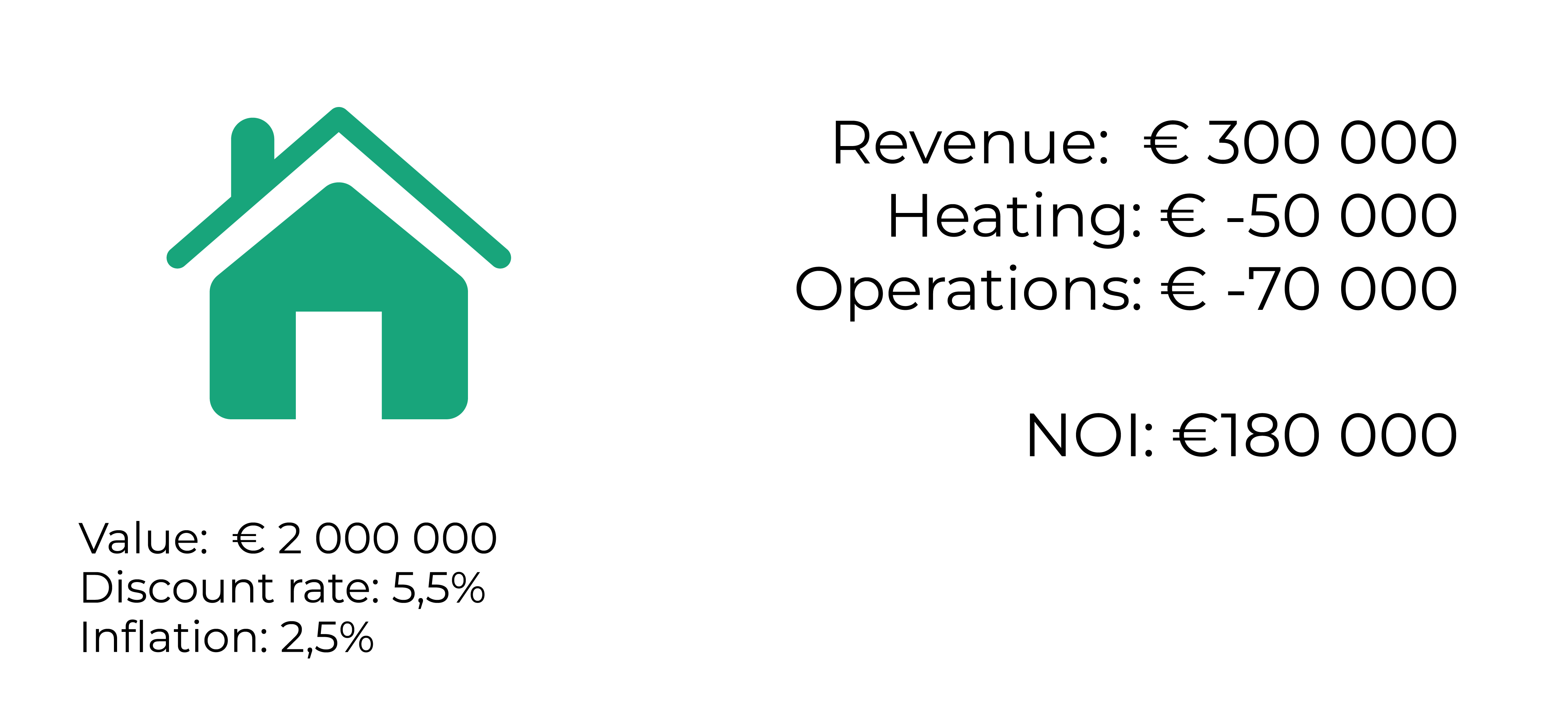

Let’s look at a property with a value of €2 million, a discount rate of 5.5%, and an inflation rate of 2.5%. The property has annual rental income of €300,000, heating costs of €50,000, and other operating costs of €70,000, resulting in an NOI of €180,000.

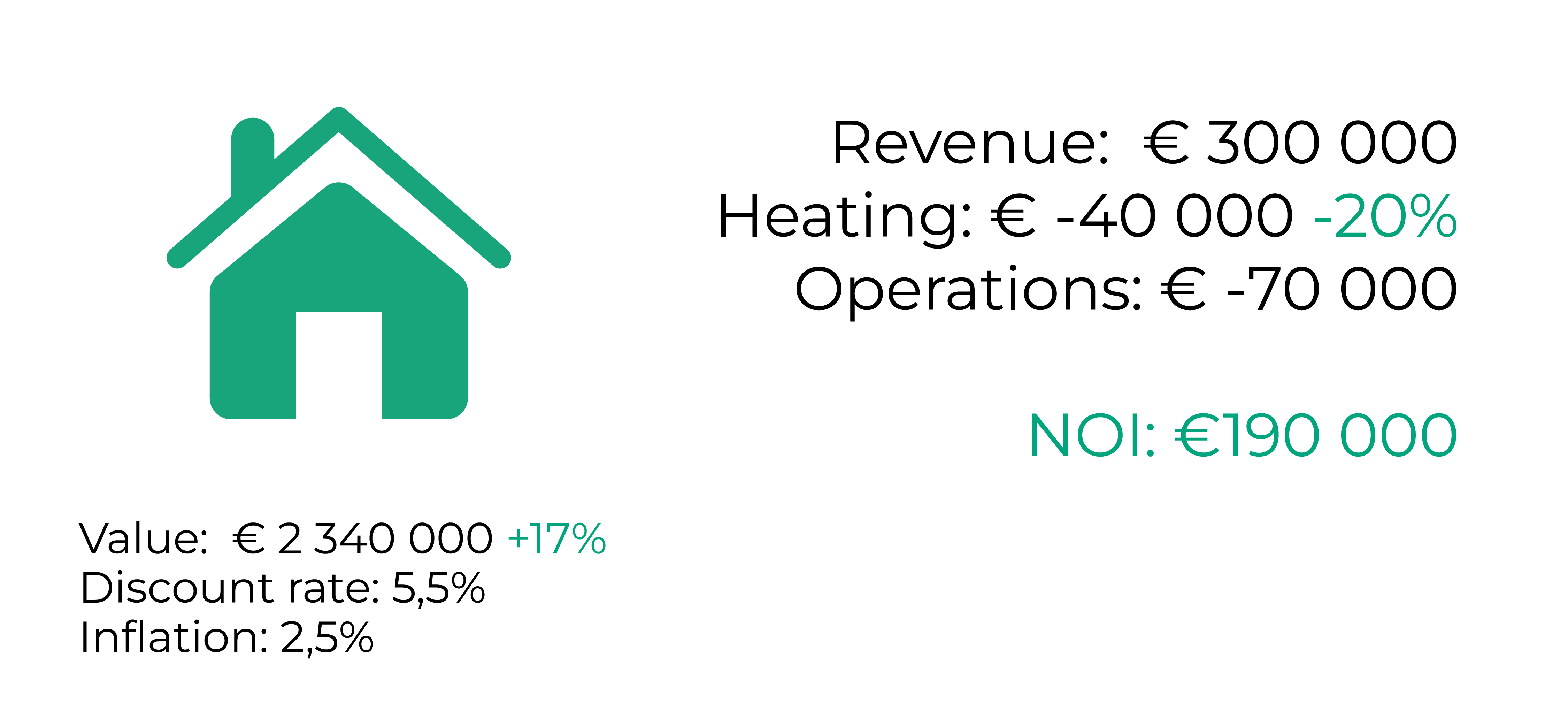

The property owner decides to invest in a modern building automation system, enabling them to adjust operations based on real-time needs. Reduced operating times, occupancy control, and more precise temperature control led to an energy-efficient building and improved NOI. With this investment, heating costs are reduced by 20% to €40,000, raising the NOI to €190,000, an annual increase of €10,000.

The increased NOI leads to a rise in property value to €2,340,000, corresponding to a 17% value increase. The final result of the investment is both reduced operational costs and a higher property value.